do nonprofits pay taxes on utilities

For assistance please contact any of the following Hodgson. Employment taxes on wages paid to employees and.

Balancing Nonprofit Administrative Costs With Growth Netsuite

But nonprofits still have to pay.

. But they do have to pay. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. Most nonprofits fall into this category and enjoy numerous tax benefits.

The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items. Yes nonprofits must pay federal and state payroll taxes.

First and foremost they arent required to pay federal income taxes. Your recognition as a 501 c 3 organization exempts you from federal income tax. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing.

The amount of property taxes a nonprofit pays depends on the assessed value of their property and the tax rate set by the local government. Nonprofits are required to pay. For merchandise Tangible Personal Property TPP rules apply.

Taxable if Income from any item given in exchange for a donation that costs the. Most nonprofits do not have to pay federal or state income taxes. 501c3s do not have to pay federal and state income tax.

Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals. But the one tax exemption that even nonprofits sometimes find.

We want to help you get the information. However here are some factors to consider when determining what taxes a nonprofit may. The underlying items are taxable or not based on existing state law whether the non-profit vendor is obligated to collect or not.

In most states nonprofits are also responsible for paying the sales tax or using a tax on their purchases and charging the sales tax on their sold items. Federal Tax Obligations of Non-Profit Corporations Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility.

2 Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com Do Nonprofits Or. Do nonprofits pay taxes on utilities Wednesday June 1 2022 Edit. Those states that provide.

State sales tax exemption on utility bills Revenue Administrative ulletin 1995-3. Taxes on money received. In most cases they wont owe income taxes at the.

Yet the parent Pepco Holdings did not pay income taxes during. We recognize that understanding tax issues related to your organization can be time-consuming and complicated. Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax.

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

Providing Essential Utility Services During Covid 19 Payments And Relief

Solar For Nonprofits Schools Churches Credit Unions Charities

Nonprofit Purchasing Tax Exempt Procurement Amazon Business

Is It Time For Nonprofits To Pay Property Taxes

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors

Balancing Nonprofit Administrative Costs With Growth Netsuite

Councilman Proposes 3 Million For Jea Bill Assistance Nonprofits

Would Non Profit Utilities Cure What Ails California Electricity Energy Institute Blog

How To Fund Your Solar Project As A Nonprofit

Catholic Charities Rent Assistance Houston Program To Help With Rent

The Nonprofit Starvation Cycle

How To Find Rent And Utility Assistance In Houston 2020

State Of Nj Department Of The Treasury Division Of Taxation Nonprofit Organizations

Nonprofit Budgets A Quick Guide Best Practices Getting Attention

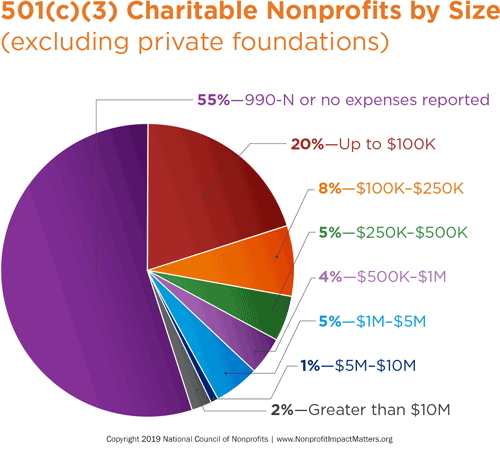

Myths About Nonprofits National Council Of Nonprofits

Would Non Profit Utilities Cure What Ails California Electricity Energy Institute Blog

List Of Nonprofits Accepting Bitcoin Crypto Donations The Giving Block